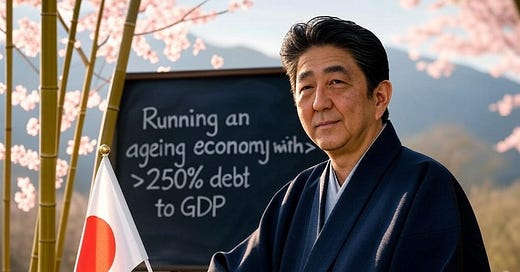

The Paradox: How JAPAN runs an Ageing Economy with >250% Debt-to-GDP

It’s crazy that, Japan’s economy has a debt-to-GDP ratio of >250%, endured decades of near-zero growth, and has never shown any signs of collapse 🙌🙌

It’s crazy that, Japan’s economy has a debt-to-GDP ratio of >250%, endured decades of near-zero growth, and has never shown any signs of collapse 🙌🙌

It defies every bit out of conventional economic wisdom. I found an interesting Twitter thread leading me into a further reading spiral.

And this is what I learnt.

This paradoxical tale of the Japanese economy began in the early 1990s.

People and businesses had gone bonkers with speculative investments in real estate and stocks during the '80s.

But, the resultant asset bubble burst in 1990, obliterating trillions in wealth

The Japanese Govt responded with crazy big fiscal stimulus, investing big in infra, bailing out banks and companies, and increasing social spending to support the ageing population

And, it was financed by insane borrowing, which significantly inflated the national debt 📛📛

..

If you think of it, the problem and the solution are much in sync with what’s been playing out in China in the last 3yrs.

Anyhow, there are three things helped the Japanese Govt endure that massive debt pile.

Over 90% of its debt is held domestically, reducing vulnerability to foreign investors or exchange rate volatility

Bank of Japan maintains near-zero interest rates through yield curve control and massive bond purchases, making debt servicing by Govt easy

Lastly, Japan's high savings rate ensures a continuous supply of capital for government borrowing. So, Govt borrows new money to pay back old one

But, maintaining this stability is becoming a challenge because of the aged population 📛📛

With 28% of its population over 65, the Govt is in perennial need of more money to fund healthcare and pensions.

This is when the same factor is driving down the workforce and taxpayer base, pushing the government towards even more debt. And consider this.

Right now, just 5% of the Indian population is over 65yrs in age. But, in 25yrs, this will be 28%. Thus, we are also going to be in similar trouble

And what’s helping the Japanese most is that they were already a high per capita income country when 1990 bubble burst. We Indians are not projected to get there in the next 30 years, forget 25

Thus, hoping that as PM Modi’s Govt completes the work on its new senior citizen policy, it will be taking notes from Japanese and making policy recalibrations to ensure we can sustain things

..

Anyhow, coming back to Japan.

Given 90%+ of Japan’s debt is held locally, the crazy big debt to GDP works because its population holds confidence in government bonds 🙌🙌

If, due to any event, if domestic savers become wary, things could get awry, theoretically.

Did you know all of this?

Best,

Jayant Mundhra

Poor economics